The digital age has erased borders, creating unprecedented opportunities for AI and data service providers to scale internationally. But entering a new market is more than just translating your website; it demands a deliberate, well-researched approach. Success hinges on choosing the right framework from a diverse set of global expansion strategies, each with unique resource requirements and risk profiles. This guide moves beyond theory to provide a practical playbook for B2B tech firms navigating international waters.

We will dissect 10 powerful strategies, from capital-intensive investments like Foreign Direct Investment to agile, asset-light models such as a Digital-First approach. For each strategy, we will outline its core mechanics, analyze its specific advantages and disadvantages, and provide real-world examples relevant to AI and data service providers. Whether you are a high-growth startup or an established enterprise, understanding these frameworks is the critical first step toward building a resilient, worldwide presence. This curated list provides the actionable insights needed to select and implement the optimal strategy for your company's next phase of growth.

1. Foreign Direct Investment (FDI): The Ultimate Commitment

Foreign Direct Investment stands as one of the most comprehensive global expansion strategies, involving a substantial, long-term commitment to a foreign market. Unlike more passive approaches, FDI means establishing a direct physical presence. This is accomplished by building facilities, acquiring an existing local company, or creating a wholly-owned subsidiary.

For B2B AI and data service providers, this translates to tangible assets like setting up a secure data annotation center in a region with a skilled, multilingual workforce or acquiring a local data analytics firm to instantly gain its client base and market credibility. This strategy grants maximum control over operations, brand messaging, and intellectual property.

When to Use FDI

FDI is the optimal choice when long-term market dominance and deep integration are the primary goals. It is ideal for companies that need to protect proprietary technology, require close quality control over service delivery, or whose business model relies heavily on local talent and infrastructure. It’s a high-stakes, high-reward approach for well-capitalized firms aiming to become a permanent fixture in a new market. Committing to a significant physical presence requires navigating complex local regulations; for instance, a complete guide to company formation in the UAE can be an essential resource for understanding the legal landscape in a key global hub.

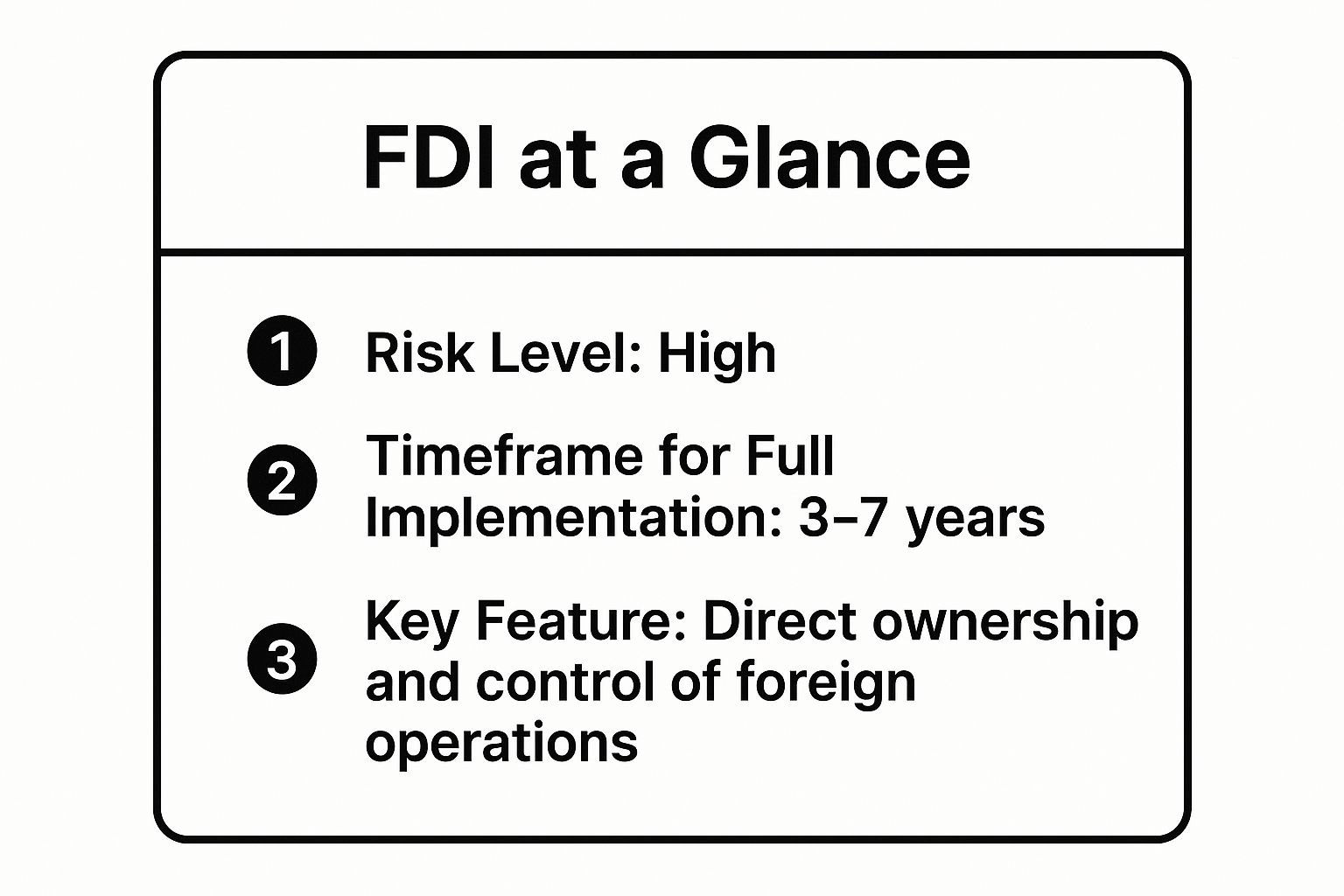

To understand the core components of this strategy, here is a quick reference summarizing the commitment involved.

As the data shows, the high risk and long implementation timeframe underscore why FDI is a strategy reserved for companies with significant resources and a clear, long-term vision for market leadership.

2. Strategic Licensing: A Low-Risk, High-Leverage Approach

Strategic Licensing offers a highly efficient path to international markets by leveraging intellectual property (IP). This model involves a company (the licensor) granting a foreign partner (the licensee) the rights to use its technology, brand, patents, or business processes. In return, the licensor receives royalties or licensing fees, allowing for rapid expansion with minimal capital investment and operational overhead.

For B2B AI and data service providers, this could mean licensing a proprietary machine learning algorithm to a local software integrator or granting a regional firm the right to use a branded data analytics platform. This strategy allows the core technology to penetrate new markets quickly through an established local partner, who handles the on-the-ground sales, marketing, and customer support.

When to Use Strategic Licensing

Strategic Licensing is one of the most effective global expansion strategies when speed and capital efficiency are paramount. It is ideal for companies with strong, defensible intellectual property but limited resources for direct investment. This approach works best in markets where a local partner's network and cultural understanding are critical for success. It is a lower-risk alternative to FDI, perfect for testing a market's potential or when the business model doesn't require a direct physical presence to maintain quality.

To successfully implement this strategy, a company must prioritize partner selection and legal protection.

As shown, the low capital requirement and fast implementation make licensing a powerful tool for agile companies aiming to scale their global footprint without the heavy commitments of direct investment.

3. Joint Ventures and Strategic Alliances: The Power of Partnership

Joint ventures and strategic alliances represent one of the most collaborative global expansion strategies, where two or more companies join forces to pursue a shared business objective. Unlike going it alone, this approach involves creating a new entity (joint venture) or a contractual agreement (strategic alliance) to pool resources, share risks, and combine complementary strengths.

For a B2B AI firm, this could mean partnering with a local telecom giant to bundle its data analytics services with their enterprise offerings, instantly accessing a massive, established client base. This strategy allows for faster market entry by leveraging a local partner's brand recognition, regulatory expertise, and distribution networks, significantly reducing the initial investment and risk.

When to Use Joint Ventures and Strategic Alliances

This strategy is ideal when a company seeks rapid market access but lacks the local knowledge, capital, or political clout to enter alone. It is particularly effective in markets with high entry barriers, such as complex regulations or dominant local players. If your goal is to mitigate risk, share substantial investment costs, and leverage a partner’s established infrastructure, a joint venture or alliance is a powerful choice. Success hinges on selecting the right partner and establishing clear governance, making thorough due diligence and well-defined legal agreements absolutely critical.

4. Franchising Model: Scaling Through Partnership

The franchising model is a powerful global expansion strategy that allows a business (the franchisor) to grant an independent operator (the franchisee) the rights to use its brand, business model, and processes. In return, the franchisor receives an initial fee and ongoing royalties. This approach facilitates rapid market penetration with reduced capital expenditure and operational burden on the parent company, leveraging the local market knowledge and investment of the franchisee.

For B2B service providers, this can mean franchising a proven service delivery framework. For instance, a data annotation company could franchise its proprietary platform, training curriculum, and quality assurance protocols to partners in different countries. The franchisee would be responsible for hiring and managing local annotators, while the franchisor maintains brand consistency and collects royalties, enabling scalable growth without managing a massive global workforce directly.

When to Use Franchising

Franchising is an excellent choice when speed-to-market and capital efficiency are top priorities. It's ideal for businesses with a highly standardized and easily replicable service or business model. This strategy works best when local expertise is crucial for navigating cultural nuances, regulations, and sales channels. It allows for rapid brand establishment across diverse regions by empowering local entrepreneurs.

For organizations considering this path, attending an International Franchising Expo can be a crucial step to connect with potential partners. To manage a widespread network effectively, franchisors must invest heavily in business process automation to ensure consistency and efficiency across all locations. This strategy hinges on a strong, documented system that can be taught and replicated with precision.

5. Export-Led Growth Strategy

An Export-Led Growth Strategy is a classic approach to international expansion where a company focuses on selling its domestically produced goods or services to foreign markets. This method leverages existing production capabilities to reach a global customer base without the immediate need for a physical presence abroad, making it one of the most accessible global expansion strategies.

For B2B AI and data service providers, this could mean offering data annotation services or licensing proprietary software to international clients directly from their home country. A U.S.-based AI firm, for example, could export its predictive analytics platform to European financial institutions by utilizing digital sales channels and remote implementation teams. This strategy minimizes initial risk and capital expenditure while testing international market appetite.

When to Use an Export-Led Strategy

This approach is ideal for companies that have a strong, scalable product or service with universal appeal and wish to enter foreign markets with minimal upfront investment. It is particularly effective for businesses that can deliver their offerings digitally, such as SaaS or AI model licensing. It's a pragmatic first step into global markets, allowing companies to build brand recognition and a customer base before committing to more capital-intensive strategies like FDI or joint ventures.

6. Acquisition and Merger Strategy

An Acquisition and Merger (M&A) strategy offers one of the most rapid paths for global expansion, involving the purchase of an existing foreign company or the merging of two firms. This approach allows a company to instantly acquire a market presence, a customer base, established operational infrastructure, and invaluable local expertise. It bypasses the slower, more organic process of building from the ground up.

For a B2B AI provider, this could mean acquiring a specialized data analytics firm in Germany to gain immediate access to the EU automotive sector or merging with a UK-based machine learning consultancy to absorb its talent and client contracts. This strategy provides immediate scale, credibility, and access to regulated markets that would otherwise take years to penetrate.

When to Use Acquisition and Merger Strategy

This strategy is ideal for well-capitalized companies aiming for rapid market entry and immediate market share. It is particularly effective when speed is a critical competitive advantage, or when entering a mature market where establishing a new brand is exceptionally difficult. An M&A approach is a powerful tool for businesses that need to acquire specific technologies, talent, or regulatory licenses quickly.

To ensure a successful outcome, it's crucial to partner with experts who can guide the complex process. For businesses considering this high-stakes approach, understanding the nuances of cross-border transactions is paramount; you can learn more about professional services for M&A integration on ziloservices.com to navigate these challenges effectively. The key to this strategy's success lies in thorough due diligence and a meticulously planned post-merger integration to realize the intended synergies and avoid cultural clashes.

7. Digital-First Global Expansion

Digital-First Global Expansion is a modern strategy that prioritizes online channels to enter and serve international markets, often without establishing a physical presence. This approach leverages e-commerce platforms, digital marketing, and cloud-based services to achieve rapid, cost-effective scaling across borders. It capitalizes on the internet's borderless nature to connect with a global customer base from day one.

For B2B AI and data service providers, this means offering SaaS platforms, APIs, or remote data annotation services to clients worldwide through a centralized digital infrastructure. Companies like Zoom and Spotify have demonstrated this model’s power, achieving massive global reach by delivering their core product entirely online. This strategy allows for agility and scalability, minimizing the upfront capital typically required for international growth.

When to Use This Strategy

A digital-first approach is ideal for businesses with inherently digital products or services, such as SaaS, software, or online marketplaces. It’s the perfect choice for companies aiming for rapid market entry and validation with minimal financial risk. This strategy is especially powerful for startups and tech firms that need to test demand in multiple regions before committing to more substantial investments like FDI. As businesses aim for borderless reach, leveraging advanced digital strategies becomes paramount. To effectively penetrate global markets, understanding how to optimize for AI-driven search is crucial. For an in-depth guide, explore Mastering AI Search Optimization.

This model's success hinges on a few core pillars:

- Scalable Technology: A robust cloud infrastructure is necessary to handle global traffic and deliver a consistent user experience.

- Localized Digital Experience: Websites, apps, and marketing content must be adapted to local languages, cultures, and consumer behaviors.

- Data-Driven Insights: Analytics are vital for understanding international user behavior and refining market strategies, a key aspect of data-driven decision-making.

8. Greenfield Investment Strategy: Building from the Ground Up

A Greenfield Investment Strategy is a form of Foreign Direct Investment where a parent company starts a new venture in a foreign country by constructing new operational facilities from the ground up. Instead of acquiring an existing business, the company builds its own, allowing for a custom-fit operation tailored precisely to its specifications, culture, and long-term vision.

For B2B AI and data service providers, this could mean constructing a state-of-the-art, secure data center in an emerging tech hub or building a new software development and R&D facility. This approach offers unparalleled control over design, technology implementation, and operational processes, perfectly aligning the new venture with the company's global standards from day one. Tesla's Gigafactories and Amazon's global fulfillment centers are prime examples of this capital-intensive strategy.

When to Use a Greenfield Investment Strategy

This is the right approach when existing facilities in the target market do not meet your specific technical or security requirements, or when you want to establish a strong brand presence without inheriting the culture or liabilities of an acquired company. It is best suited for well-funded companies that prioritize long-term control and customization over speed to market. This strategy is one of the more complex global expansion strategies, demanding extensive market research, strong local government relations, and a significant investment in developing local talent.

9. Multi-Domestic Strategy: Think Local, Act Local

A Multi-Domestic Strategy is a decentralized approach to international expansion where a company treats each foreign market as a distinct entity. Instead of enforcing a standardized global model, this strategy involves extensively adapting products, services, marketing, and operations to align with the unique cultural preferences, regulations, and consumer behaviors of each country. It prioritizes local responsiveness over global integration.

For a B2B AI firm, this could mean developing a credit scoring algorithm specifically tailored to the financial regulations and data privacy laws of a single European country. It might also involve creating a natural language processing (NLP) tool that deeply understands local dialects and cultural nuances, rather than using a one-size-fits-all language model. This approach maximizes local relevance and market penetration.

When to Use a Multi-Domestic Strategy

This is one of the most effective global expansion strategies when there are significant differences in consumer tastes, cultural norms, or regulatory environments between countries. It is ideal for companies whose products or services are closely tied to local culture, such as media, food, or consumer goods. For tech firms, it works best when data sovereignty laws or specific industry standards demand highly customized solutions.

Companies like Unilever and P&G have mastered this by creating country-specific product formulations and marketing campaigns. Success with this strategy requires a deep investment in local market research and the empowerment of strong local management teams who can make autonomous decisions. The goal is to become an "insider" in every market you serve.

10. Platform Ecosystem Strategy: Building a Global Network

A Platform Ecosystem Strategy is a modern approach to global expansion that focuses on building a digital platform to connect multiple user groups, such as customers, suppliers, and third-party developers. Instead of establishing direct operational control in every market, the company facilitates value exchange between these groups, leveraging network effects to scale rapidly across borders. This model thrives on creating a self-sustaining ecosystem that grows organically as more participants join.

For B2B AI and data service providers, this could mean creating a global marketplace for specialized machine learning models where developers can sell their creations to enterprises worldwide. Another example is a data annotation platform that connects businesses needing labeled datasets with a global network of vetted freelance annotators. The platform owner profits by enabling these connections, managing quality, and processing transactions, rather than performing the services directly.

When to Use a Platform Ecosystem Strategy

This strategy is ideal for businesses that can create significant value by connecting fragmented markets or user groups. It is one of the most powerful global expansion strategies for companies with a strong technological foundation aiming for exponential, low-capital-intensive growth. A platform model works best when the value for each user increases as more users join, creating a powerful competitive moat. It's a strategic choice for ventures looking to disrupt traditional industries by becoming the central hub for transactions and innovation, much like Amazon's marketplace or Apple's App Store.

Global Expansion Strategies Comparison Matrix

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Foreign Direct Investment (FDI) | High – lengthy setup, regulatory challenges | High – substantial capital, local talent | High impact – full control, market integration | Long-term market presence, full ownership | Complete control, local market access, higher ROI |

| Strategic Licensing | Low to Medium – contract management | Low – minimal capital, partner resources | Moderate – revenue from royalties | Rapid expansion with IP, minimal investment | Low risk, fast entry, leverages partner expertise |

| Joint Ventures & Alliances | Medium – complex governance and coordination | Medium – shared investment and resources | High – shared risks and benefits | Access to local knowledge, resource sharing | Shared risk, local expertise, faster entry |

| Franchising Model | Low to Medium – standardized processes | Low to Medium – franchisee investment | Moderate – rapid scaling via local operators | Global brand replication with limited direct control | Rapid expansion, scalable, reduced risk |

| Export-Led Growth Strategy | Low – mainly logistics and compliance | Low – uses existing production capacity | Moderate – tests markets, generates revenue | Exporting goods/services with minimal local presence | Low investment, centralized control, market testing |

| Acquisition and Merger | High – complex integration, due diligence | High – significant financial outlay | High – instant market access and synergies | Fast market entry via acquisition of local firms | Immediate presence, access to talent, synergies |

| Digital-First Global Expansion | Low to Medium – technology setup and digital marketing | Low to Medium – tech infrastructure and marketing | High – rapid scaling, data-driven insights | Online market entry without physical presence | Low entry barrier, fast scaling, adaptable |

| Greenfield Investment Strategy | High – building from scratch, regulatory hurdles | High – capital intensive, local hiring | High – full control, tailored operations | Establishing wholly new operations abroad | Custom facilities, control, no legacy issues |

| Multi-Domestic Strategy | Medium – decentralized, requires adaptation | Medium to High – R&D, local teams | High – strong local market fit and responsiveness | Markets needing high local customization | Local relevance, customer appeal, cultural fit |

| Platform Ecosystem Strategy | High – complex tech, network building | High – technology development, partnerships | Very High – network effects, scalable growth | Digital marketplaces and multi-stakeholder ecosystems | Exponential growth, diverse revenue, strong moat |

Choosing Your Path to Global Leadership

Navigating the complexities of international markets requires more than just a great product or service; it demands a meticulously crafted expansion plan. Throughout this guide, we have explored a diverse range of global expansion strategies, from the capital-intensive commitment of Foreign Direct Investment and Greenfield projects to the agile, asset-light models of Digital-First expansion and Strategic Licensing. Each path offers a unique blend of control, risk, and resource allocation, underscoring a critical truth: there is no one-size-fits-all solution for global growth.

Your ideal strategy is not a static choice but a dynamic roadmap. For many AI and data service providers, the journey may begin with a lower-risk approach like an Export-Led model, allowing you to test market demand and build initial traction. As your understanding of the local landscape deepens and revenue streams solidify, you can progressively layer on more committed strategies, such as forming a Joint Venture to leverage local expertise or pursuing a strategic Acquisition to rapidly gain market share.

Key Takeaways for Ambitious Leaders

The most successful global companies master the art of strategic evolution. They understand that the right approach for entering Europe may differ entirely from the optimal strategy for Asia. The core challenge lies in balancing ambition with operational reality.

- Align Strategy with Resources: Your available capital, team bandwidth, and risk tolerance are the primary filters for selecting an appropriate strategy. An early-stage startup will likely prioritize different models than an established enterprise.

- Prioritize Cultural Intelligence: A successful global expansion hinges on more than just logistics and legal compliance. It requires a deep understanding of local business etiquette, consumer behavior, and regulatory nuances.

- Build a Scalable Foundation: Regardless of the chosen strategy, your operational backbone must be prepared for growth. This includes scalable technology, flexible talent pipelines, and robust data management capabilities that can adapt to diverse market needs.

Ultimately, mastering these global expansion strategies is about transforming your organization from a domestic player into a recognized international leader. The goal is to build a resilient, adaptable business that can thrive in any environment. This journey requires careful planning, decisive execution, and the right partners to support your vision. By thoughtfully selecting and sequencing your strategies, you can mitigate risks, accelerate growth, and unlock the immense potential that awaits on the global stage. Your path to global leadership is a marathon, not a sprint, and the choices you make now will define your company's international legacy.

Ready to build the operational backbone for your global expansion? Zilo AI provides on-demand access to a global workforce for high-quality data annotation, transcription, and translation services, helping you scale efficiently in any market. Discover how our platform can de-risk your international growth by visiting Zilo AI today.