The insurance industry is navigating a period of significant operational pressure, driven by evolving customer expectations, complex regulatory landscapes, and the urgent need for digital integration. To remain competitive, insurers are increasingly looking for ways to streamline processes, reduce overhead, and enhance their core service offerings. This is where strategic partnerships with top-tier insurance outsourcing companies become a critical advantage, allowing carriers and agencies to offload non-core functions and focus on what they do best: managing risk and serving policyholders.

This comprehensive resource is designed to cut through the noise and help you identify the right partner for your specific needs. We go beyond generic marketing claims to provide a detailed analysis of the leading providers in the market. You'll gain practical insights into how these firms handle everything from claims processing and policy administration to underwriting support and customer service. For instance, many insurers consider outsourcing lead generation to specialized agencies to focus on core competencies, and this list covers companies that excel in that area and many others.

Our goal is to equip you with the information needed to make a confident, informed decision. For each company on our list, you will find:

- A concise overview of their core insurance services.

- Specific use cases and real-world applications.

- An honest assessment of their strengths and potential limitations.

- Direct links to their websites and relevant service pages.

By the end of this article, you will have a clear understanding of the landscape of insurance outsourcing companies and be better prepared to select a partner that aligns with your operational goals, technological requirements, and long-term business strategy.

1. Services – Zilo

Zilo emerges as a standout choice among insurance outsourcing companies by uniquely merging expert human intelligence with sophisticated AI capabilities. This powerful combination is specifically engineered to handle the data-intensive challenges prevalent in the insurance sector, from claims processing to customer interaction analysis. Their platform excels in transforming vast amounts of unstructured data into actionable, high-quality insights.

What truly sets Zilo apart is its focus on specialized data annotation and transcription services, driven by linguistic experts. This allows insurance carriers to process and understand multilingual claims documents, recorded customer calls, and complex policy texts with exceptional accuracy and nuance. By leveraging Zilo, insurers can significantly enhance their data-driven decision-making processes.

Core Strengths and Use Cases

Zilo's services provide a strategic advantage for insurance firms looking to innovate and streamline operations. The integration of managed human teams with AI tools creates a robust system for handling complex data tasks that pure automation often struggles with.

- Claims Processing Automation: Insurers can use Zilo to annotate and categorize images of property damage, transcribe audio recordings of client interviews, and extract key information from unstructured claim forms. This accelerates the validation process, reduces manual error, and helps in early fraud detection.

- Customer Sentiment Analysis: By transcribing and translating customer service calls from multiple languages, Zilo enables insurers to analyze feedback on a global scale. This helps in identifying service gaps, improving customer retention, and refining product offerings.

- Policy and Underwriting Support: Zilo's team can annotate and structure data from complex legal and medical documents, providing underwriters with cleaner, more organized datasets for accurate risk assessment and policy pricing.

Key Advantage: Zilo’s fusion of skilled human oversight with AI-powered data processing ensures a level of accuracy and contextual understanding that is critical for high-stakes insurance operations, turning raw data into a reliable strategic asset.

Visit the website: https://ziloservices.com/services/

2. EXL

EXL stands out as a major U.S.-centric insurance outsourcing company, specializing in data-driven operations for Property & Casualty (P&C) and Life & Retirement (L&R) sectors. Their deep domain expertise is consistently recognized, earning them a "Leader" designation in ISG’s 2023–2024 Insurance Services report for North America.

This provider is ideal for established carriers seeking an end-to-end partner. EXL manages the entire policy lifecycle, from first notice of loss (FNOL) to subrogation in P&C, and new business processing to claims management in L&R. Their strength lies in combining human expertise with powerful analytics and AI, exemplified by their EXL Pro L&R platform, which automates and optimizes complex processes.

Key Considerations for EXL

- Best Use Case: Large to enterprise-level North American carriers needing to modernize core operations, improve efficiency through analytics, or outsource entire functions like third-party administration (TPA).

- Standout Feature: The integration of advanced data analytics and AI into their core outsourcing services. This digital-first approach helps carriers not just cut costs but also derive actionable insights from their operational data.

- Limitations: EXL's enterprise focus and custom-built programs mean their services may be less accessible for smaller insurers or MGAs. Pricing is not publicly available and requires direct consultation, reflecting the tailored nature of their engagements.

Website: https://www.exlservice.com/industries/insurance

3. WNS

WNS is a global leader among insurance outsourcing companies, providing Business Process Management (BPM) services across Property & Casualty (P&C), Life & Retirement (L&R), and specialty lines. Regularly ranked as a "Leader" by ISG, WNS combines deep domain knowledge with advanced digital transformation capabilities, including hyper-automation and analytics.

Their services are particularly suited for insurers looking to modernize legacy systems or rapidly launch new products. WNS offers modular, platform-led operating models that can be customized to specific needs. A key differentiator is their InVog BPaaS platform, an "insurance-in-a-box" solution designed to accelerate greenfield initiatives and legacy modernization by bundling technology, processes, and skilled personnel. Their established partnerships with reinsurers, brokers, and insurtechs further enhance their ability to deliver comprehensive, end-to-end solutions.

Key Considerations for WNS

- Best Use Case: Mid-to-large-sized carriers, MGAs, or insurtechs that need to launch new products quickly, modernize core functions, or access specialized expertise through a flexible, platform-based model.

- Standout Feature: The InVog BPaaS "insurance-in-a-box" platform. It provides a pre-configured, end-to-end operational framework that significantly reduces time-to-market for new ventures or modernization projects.

- Limitations: The comprehensive nature of their transformation programs may require significant organizational change management. Their focus on mid-to-large enterprise clients means their solutions may be less accessible for very small insurers or startups with limited budgets. Pricing is customized and requires direct consultation.

Website: https://www.wns.com/industries/insurance

4. Genpact

Genpact is a major player among insurance outsourcing companies, recognized for its deep expertise in business process transformation for global Property & Casualty (P&C) carriers and brokers. With over two decades of experience, they blend traditional BPO with advanced technology, focusing on AI-driven automation to streamline complex insurance operations from end to end.

Their services are built to drive measurable improvements in key performance indicators like cycle time and touchless processing rates. A key differentiator is their focus on "agentic AI" solutions, such as the Genpact Insurance Policy Suite, designed to automate underwriting and submission intake at scale. This forward-thinking approach to business process automation positions them as a partner for carriers looking not just to outsource, but to fundamentally transform their operating models for the digital era.

Key Considerations for Genpact

- Best Use Case: Enterprise-level carriers and brokers aiming to modernize core functions like underwriting, claims, and customer experience through a combination of onshore/offshore process management and AI-powered automation.

- Standout Feature: The Genpact Insurance Policy Suite and its focus on "agentic AI" to handle complex tasks like submission triage and underwriting decisions, promising significant gains in speed and efficiency.

- Limitations: The AI-powered suite is a relatively new offering, meaning its real-world case studies are still maturing. Large-scale enterprise adoption will likely require significant IT and security due diligence to ensure seamless integration and compliance.

Website: https://www.genpact.com/industries/insurance

5. Cognizant

Cognizant excels in blending digital transformation consulting with hands-on insurance business process services (BPS). As one of the prominent insurance outsourcing companies, it focuses on modernizing core operations through an "automation-first" approach, serving both Property & Casualty (P&C) and Life & Annuities sectors with a strong U.S. footprint.

This provider is particularly suited for carriers looking to not only outsource functions but also fundamentally transform them. Cognizant offers end-to-end management of claims, policy administration, and new business processes, embedding AI and analytics to drive ROI. Their model combines transformation services to re-engineer workflows with ongoing "run" services to manage them efficiently, offering scalable support across various distribution channels.

Key Considerations for Cognizant

- Best Use Case: Mid-to-large-sized carriers aiming to modernize legacy systems and processes. Their model is ideal for companies that need a partner to both advise on and execute a digital transformation strategy while outsourcing daily operations.

- Standout Feature: The integrated "transform and run" service model. This dual capability allows clients to engage a single partner for both strategic modernization projects and the subsequent operational management, ensuring a smoother transition and better alignment.

- Limitations: The complexity of their integrated programs can lead to longer ramp-up and transition times compared to providers offering more straightforward BPS. Pricing and specific service level agreements are not publicly available and require detailed consultation, reflecting the custom nature of their solutions.

6. Infosys BPM

Infosys BPM leverages its strong heritage in business process management to deliver comprehensive services across the insurance value chain. Serving a global client base, this provider offers robust support for both Property & Casualty (P&C) and Life & Retirement (L&R) carriers, covering everything from underwriting and policy administration to complex claims processing and reinsurance accounting.

The company is a solid choice for insurers looking for a partner with a mature, process-driven methodology. Infosys BPM’s strength lies in its global delivery model, which combines offshore efficiency with onshore expertise, making it one of the more versatile insurance outsourcing companies. Their services extend to intermediaries like brokers and MGAs, offering support for licensing, commissions, and compliance, which is a key differentiator. This focus on process excellence is crucial for making data-driven decisions that enhance operational performance.

Key Considerations for Infosys BPM

- Best Use Case: Mid-to-large-sized P&C and L&R carriers, as well as intermediaries like MGAs, seeking a full-spectrum outsourcing partner with a strong global footprint and proven process optimization frameworks.

- Standout Feature: Its extensive service portfolio, which includes specialized reinsurance BPO services like contract administration and technical accounting, along with dedicated support for insurance intermediaries.

- Limitations: The recent cybersecurity incident involving its subsidiary, Infosys McCamish, requires potential clients to perform extra due diligence regarding security protocols. Like other enterprise providers, pricing is not transparent and requires direct consultation.

Website: https://www.infosysbpm.com/industries/insurance.html

7. TCS (Tata Consultancy Services)

TCS is a global IT and business solutions titan, offering large-scale insurance outsourcing backed by its powerful TCS BaNCS platform. The company is a dominant force in both the Property & Casualty (P&C) and Life & Pensions sectors, consistently recognized by Everest Group for its Business Process Services (BPS) and third-party administration (TPA) capabilities, particularly in North America.

This provider excels at handling massive, complex transformation projects for enterprise-level insurers. TCS manages everything from closed-block administration for legacy life and annuity books to live policy and claims processing. Their approach integrates cloud infrastructure and cognitive solutions directly with the BaNCS platform, creating a unified ecosystem for modernizing core insurance operations and driving digital efficiency at scale.

Key Considerations for TCS

- Best Use Case: Large, multinational insurance carriers seeking a long-term partner for comprehensive digital transformation, legacy system modernization, or outsourcing entire complex functions like Life & Pensions administration.

- Standout Feature: The deep integration of its proprietary TCS BaNCS platform with its BPS offerings. This allows TCS to provide a tightly coupled technology and services solution, reducing vendor complexity and ensuring platform expertise is embedded in the outsourced operations.

- Limitations: TCS is built for enterprise-scale engagements, which often involve long sales cycles and significant transition planning. Their services are not suited for smaller insurers or MGAs, and pricing is bespoke, requiring extensive consultation.

Website: https://www.tcs.com/industries/insurance

8. Sutherland

Sutherland carves out a niche among insurance outsourcing companies by focusing on customer experience (CX) transformation and modernizing the back office for carriers, brokers, and managing general agents (MGAs). Recognized by Everest Group for its P&C Business Process Services (BPS) and intermediary support, Sutherland leverages a blend of human talent and technology to streamline insurance operations from end to end.

The company excels in policy administration, claims processing, and underwriting support, but its true differentiator lies in its deep insurtech integrations. Through partnerships with platforms like Benekiva for claims automation, Ushur for customer engagement, and Bold Penguin for commercial lines quoting, Sutherland accelerates workflows and enhances operational intelligence. This "AI-in-the-loop" approach empowers clients to not just outsource processes but fundamentally redesign them for efficiency and better customer outcomes.

Key Considerations for Sutherland

- Best Use Case: Mid-sized to large carriers, brokers, or MGAs looking to overhaul their customer experience or digitize intermediary-facing processes. Their model is especially suited for organizations wanting to leverage best-in-class insurtech solutions without managing multiple vendor relationships.

- Standout Feature: The extensive network of pre-built integrations with leading insurtech partners. This allows for rapid deployment of advanced automation and AI capabilities within core insurance functions, from new business intake to claims settlement.

- Limitations: While Sutherland highlights its technological prowess, there is limited public detail on insurance-specific case metrics and performance benchmarks. Additionally, its global delivery model may require U.S.-based clients to verify local licensing and compliance requirements for certain regulated activities.

Website: https://www.sutherlandglobal.com/industries/insurance

9. Teleperformance

Teleperformance is a global giant in customer experience (CX) management, offering a massive scale of operations for insurance carriers, MGAs, and brokerages. While broadly focused on CX, they have a dedicated vertical that provides specialized insurance outsourcing services, including licensed agent sales support, first notice of loss (FNOL) intake, and comprehensive claims and policy administration. Their ability to manage U.S. insurance licensing and provide onshore P&C support makes them a formidable partner.

The company excels in managing fluctuating demand, particularly during peak seasons or catastrophic events. Their global, multilingual footprint combined with digital tools allows them to handle surge capacity seamlessly, ensuring business continuity for their clients. For insurers looking to outsource their front-office customer interactions or require licensed agents for sales and service without the overhead, Teleperformance offers a robust, scalable solution.

Key Considerations for Teleperformance

- Best Use Case: Large carriers or brokerages needing to scale their customer-facing operations, especially for seasonal peaks or catastrophe response. Ideal for outsourcing licensed U.S. sales support or claims intake functions.

- Standout Feature: Their immense global scale and infrastructure dedicated to managing licensed insurance agent programs. This allows them to handle complex U.S. licensing requirements and provide onshore support, which is a significant differentiator among general BPOs.

- Limitations: While strong in CX and front-office functions, organizations needing deep back-office expertise like complex underwriting, actuarial support, or full third-party administration (TPA) may need to partner with a more specialized provider. Their AI-driven accent neutralization tools have also raised some cultural and brand alignment questions.

Website: https://www.teleperformance.com/industries/insurance/

10. Wipro

Wipro offers a broad spectrum of insurance Business Process as a Service (BPaaS) and BPO solutions, with deep capabilities in both Property & Casualty (P&C) and U.S. health insurance. The acquisition of HealthPlan Services significantly bolstered their U.S. presence, providing them with a robust platform for health payers, including support for public and private exchanges.

As one of the well-established insurance outsourcing companies, Wipro is well-suited for carriers and health plans seeking a partner that can provide both point solutions, like underwriting support and smart claims processing, and comprehensive end-to-end outsourcing. Their offerings include full policy lifecycle management from quoting and issuance to renewals, claims, and subrogation, often accelerated by robotic process automation. The company's significant presence in India also positions it as a major player in global service delivery; you can learn more about Wipro's standing among Indian service companies on ziloservices.com.

Key Considerations for Wipro

- Best Use Case: U.S. health insurance payers needing platform-based BPO for exchange management, or P&C carriers looking for a mix of discrete process outsourcing (e.g., claims) and technology-driven efficiency.

- Standout Feature: The combination of a strong BPaaS platform, particularly for U.S. health payers, with a suite of RPA accelerators. This allows them to deliver both comprehensive and targeted automation solutions.

- Limitations: The company's insurance offerings are spread across several sections of their main website, which can make it difficult to get a unified view of their capabilities. While still relevant, many of their publicly cited analyst rankings are older than those of competitors.

Website: https://www.wipro.com/business-process/insurance/

11. DXC Technology

DXC Technology occupies a unique space in the insurance outsourcing market by combining its proprietary software suite, DXC Assure, with extensive Business Process Services (BPS). This integrated approach allows them to manage complex, large-scale operations for both Property & Casualty (P&C) and Life & Annuity (L&A) carriers, functioning as a fully licensed Third-Party Administrator (TPA) in the U.S. and Canada.

Their service is built around modernizing legacy systems. DXC specializes in migrating carriers from outdated platforms to their modern, automated environment, which features over 140 pre-built insurance processes. This makes them a compelling choice for established insurers looking to execute a complete technological and operational transformation under a single vendor, a key reason they are listed among top-tier insurance outsourcing companies.

Key Considerations for DXC Technology

- Best Use Case: Enterprise-level carriers needing to migrate from cumbersome legacy systems, or those seeking a unified provider for both core insurance software and outsourced administration services.

- Standout Feature: The tight integration of their DXC Assure software platform with their BPS offerings. This single-stack solution simplifies vendor management and ensures that the technology and the operational teams are perfectly aligned.

- Limitations: The scale of DXC's engagements means they are best suited for large, complex projects. Their enterprise-class governance and customized packaging may create a significant barrier to entry for smaller insurers or startups.

Website: https://dxc.com/us/en/offerings/insurance-software-bps

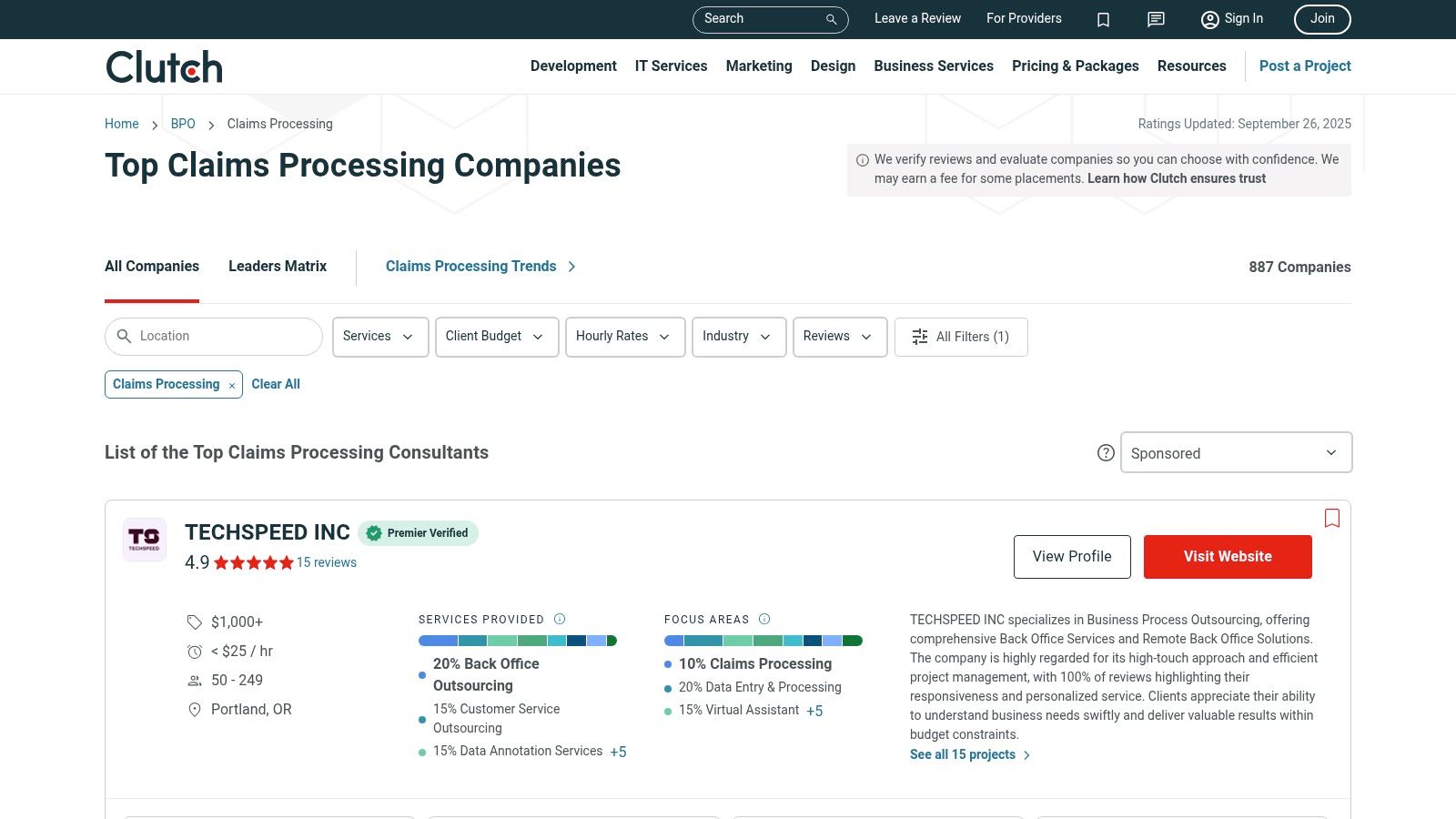

12. Clutch

Clutch is not a direct provider but an essential B2B directory for finding and vetting boutique and mid-market insurance outsourcing companies. It offers a transparent marketplace where businesses can compare vendors based on verified client reviews, project portfolios, and service focus, making it particularly useful for identifying specialists in areas like claims processing or back-office support.

This platform excels at bringing visibility to smaller, highly specialized firms that might not appear in traditional analyst reports. Its robust filtering system allows users to narrow down providers by location, budget, and specific insurance services. For a small to mid-sized agency or MGA, Clutch provides a powerful tool to short-list potential partners with proven track records serving U.S. clients, complete with direct RFP outreach capabilities.

Key Considerations for Clutch

- Best Use Case: Small to mid-sized insurers, MGAs, or brokers looking for specialized, niche providers for specific functions like claims administration or policy checking, where verified client feedback is a critical decision factor.

- Standout Feature: The depth of verified client reviews and project snapshots. This provides genuine insight into a provider’s communication, quality, and reliability before initiating contact, reducing the risk of a bad partnership.

- Limitations: The quality of listed vendors varies significantly, and careful due diligence is still required. Some BPO categories are heavily populated by healthcare billing services, so users must carefully filter to confirm a provider’s specific P&C or L&A insurance expertise.

Website: https://clutch.co/bpo/claims-processing

Top 12 Insurance Outsourcing Providers Comparison

| Provider | Core Features & Services | User Experience & Quality ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ | Price Points 💰 |

|---|---|---|---|---|---|---|

| Zilo AI | Text, image, voice annotation; transcription, translation | Linguistic experts, multilingual annotation | Expert manpower + AI-enabled data annotation | AI/data-driven businesses globally | Multilingual linguistic specialists 🏆, tailored manpower | Not publicly detailed |

| EXL | P&C & L&R insurance ops, analytics, TPA services | Leader recognition, strong governance | Deep domain expertise, digital-first ops | Large U.S. insurers & TPAs | ISG leader for insurance services 🏆 | Customized; not public |

| WNS | P&C & L&R, actuarial COE, hyper-automation | Regional leader, platform-led models | Modular, fast launches via BPaaS | Mid to large insurers | InVog BPaaS insurance-in-a-box ✨ | Not public |

| Genpact | Underwriting, claims, AI accelerators | Strong AI innovation, analyst recognition | Speed & cost improvements | U.S. carriers & brokers | Agentic AI suite for underwriting ✨ | Not public |

| Cognizant | End-to-end BPS, automation-first | Consulting + delivery blend | Scalable multi-line modernization | Large insurers | ROI-driven hybrid digital ops ✨ | Not public |

| Infosys BPM | P&C & L&R ops, reinsurance, global delivery | Mature Six Sigma processes | Broad menu incl. intermediary support | Insurers & brokers globally | Mature frameworks, global/U.S. experience | Not public |

| TCS | Policy admin, claims, cloud/cognitive, TPA | Platform expertise, large-scale transformation | Deep Life & Pensions expertise | Large insurers & complex programs | BaNCS platform-backed, licensed TPA | Not public |

| Sutherland | CX & back-office, policy, claims, underwriting | Strong CX focus, insurtech integrations | Specialized intermediary outsourcing | Carriers, brokers, MGAs | Extensive insurtech partnerships ✨ | Not public |

| Teleperformance | Licensed U.S. sales, FNOL, claims, peak mgmt | Massive scale, surge handling | Onshore licensed P&C support | Large carriers & brokerages | Licensed U.S. insurance agent sales 🏆 | Not public |

| Wipro | Underwriting, claims, BPaaS, RPA | Platform/process focus | Combination of point & end-to-end | U.S. health & insurance payers | U.S. health exchanges platform & RPA ✨ | Not public |

| DXC Technology | Insurance software + BPS, licensed TPA | Integrated software + services | Migration & modernization expertise | Large insurers | DXC Assure BPM platform + AWS marketplace soon ✨ | Customized pricing |

| Clutch | Vendor rankings, RFP tools, buyer reviews | Transparent with client feedback | Quick specialist identification | U.S. BPO buyers & insurers | Verified reviews and up-to-date vendor data ✨ | Free directory |

Making Your Final Decision and Moving Forward

Navigating the landscape of insurance outsourcing companies can feel overwhelming, but this guide has equipped you with the foundational knowledge to make a strategic, informed decision. We've explored a diverse array of providers, from global powerhouses like TCS and Infosys BPM, known for their end-to-end digital transformation capabilities, to specialized firms like EXL that offer deep domain expertise in analytics and risk management. The key takeaway is that the "best" partner is not a one-size-fits-all solution; it's the one that aligns precisely with your organization's specific needs, scale, and strategic objectives.

Your journey began with understanding the core benefits of outsourcing, moving beyond simple cost reduction to embrace enhanced operational efficiency, access to specialized talent, and the ability to focus on core business functions like product innovation and customer relationships. The detailed analysis of providers like Genpact, WNS, and Sutherland highlighted the importance of industry-specific solutions, whether in property and casualty, life and annuities, or healthcare insurance sectors.

Synthesizing Your Options: Key Decision Factors

As you move toward a final decision, distill your findings by focusing on the most critical evaluation criteria discussed throughout this article. Remember, the right partnership is a strategic alliance, not just a vendor transaction.

- Technology and Innovation: Did the provider demonstrate a commitment to leveraging AI, machine learning, and automation? Companies like Cognizant and Wipro excel here, offering platforms that can modernize legacy systems and drive intelligent process automation, a crucial factor for future-proofing your operations.

- Domain Expertise: How deep is their knowledge of the insurance value chain? A provider's understanding of underwriting, claims processing, policy administration, and regulatory compliance is non-negotiable. This is where firms with a long history in the sector truly shine.

- Scalability and Flexibility: Your business needs will evolve. Can your chosen partner scale their services up or down accordingly? Evaluate their global delivery models and their ability to adapt to market shifts, as demonstrated by companies like Teleperformance and DXC Technology.

- Security and Compliance: The insurance industry is built on trust and data security. Scrutinize each potential partner's certifications (like ISO 27001, HIPAA, and GDPR compliance), data encryption protocols, and disaster recovery plans. This is a foundational pillar for any successful outsourcing relationship.

Actionable Next Steps for Selecting Your Partner

With your research complete, it's time to move from analysis to action. The selection process itself requires a structured approach to ensure you find the perfect fit among the many qualified insurance outsourcing companies.

- Create a Detailed Request for Proposal (RFP): Document your specific requirements, key performance indicators (KPIs), expected service levels, and long-term goals. This forces internal alignment and provides a clear, consistent benchmark for evaluating vendor responses.

- Conduct Rigorous Due Diligence: Go beyond the marketing materials. Request case studies relevant to your specific challenges, schedule in-depth consultations, and ask for client references you can speak with directly.

- Evaluate Cultural Fit: A successful outsourcing partnership often depends on seamless collaboration. Assess the provider's communication style, project management methodologies, and overall approach to client relationships. Do their values align with yours?

- Plan for Implementation and Governance: Before signing a contract, outline a clear implementation roadmap. Define governance structures, communication protocols, and performance review schedules to ensure a smooth transition and ongoing alignment. For functions like customer interaction, it's critical to ensure brand voice and service quality are maintained. To identify a partner truly aligned with industry-specific needs, consider insights on finding the best call center for insurance companies.

Choosing an outsourcing partner is one of the most significant strategic decisions an insurance organization can make. It's an opportunity to redefine your operational model, unlock new efficiencies, and position your company for sustained growth in an increasingly competitive market. By applying the insights and frameworks from this guide, you are well-prepared to select a partner that will not just handle tasks, but actively contribute to your long-term success.

Ready to harness the power of AI-driven data solutions to supercharge your insurance operations? Zilo AI offers specialized data annotation and business process outsourcing services designed to train the next generation of insurance-focused AI models. Explore how our precise, scalable, and secure solutions can transform your data into a competitive advantage by visiting Zilo AI today.